|

QuickBooks 4 Jewelers

QuickBooks for jewelers who do not own a point of sale program

===================================================================================================

(NOTE: this is for store without a jewelry point of sale program. if you own The Edge or Jewelry Shopkeeper please click on this link to see our page specific to that program)

===================================================================================================

If you're are "smaller store" and do not have a separate point of sale program to keep inventory and record sales of any type (i.e. the Edge/Jewelry Shopkeeper/Guild/ QB POS/Arms) you'll still need a good accounting program.

How do I define "smaller store"?

Right off the bat if you own less than $90,000.00 of inventory at cost and your sales are probably less than $400,000.00 and are mostly shop related sales you can run a business with just QuickBooks accounting program.

I always suggest using a program like The Edge or Jewelry Shopkeeper and have those programs export sales into your regular QuickBooks accounting program (which is another service I help jewelers with all of the time.) but can be done for a small store with just QuickBooks accounting program/

So how does this work?

You must of course own QuickBooks desktop. Its less than $190.00 at Amazon. QuickBooks online is not a good program to use, if your accountant wants you to use online it's so they can access your file from their office. it can be done with an inexpensive connection software where you and your cpa can connect to your Quickbooks even from a cruise ship. Online version is not up to par, stick to QuickBooks desktop.

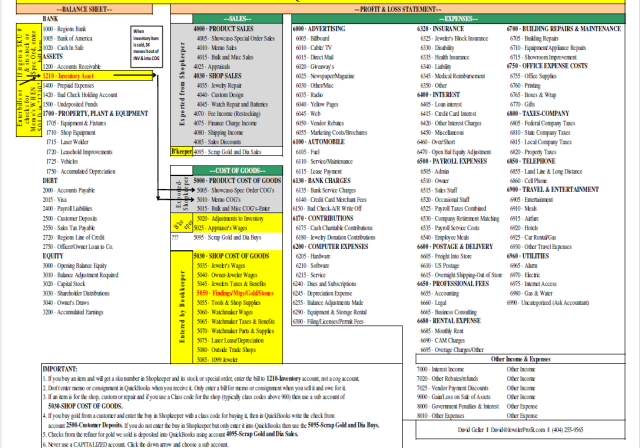

If you've never used Quickbooks before; you'll buy it from Amazon or any office supply store and I'll make a new file for you, which will look like the picture below, don't let it confuse you.

If you already own a copy of Quickbooks I will connect to your computer and alter your QB accounts to be like these. they are specific to a jewelry store and I set this up for our three major ways of making money in a store.

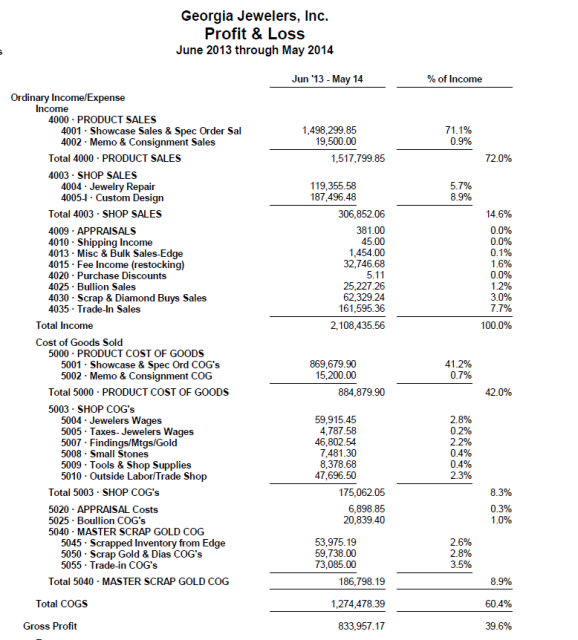

- Selling product

- Selling Repairs & Custom Design

- Selling Scrap Gold

When setup in this manner you'll get a wonderful profit & loss statement, many times better and more accurate than your accountant gives you and you don't have to wait until year end to see it.

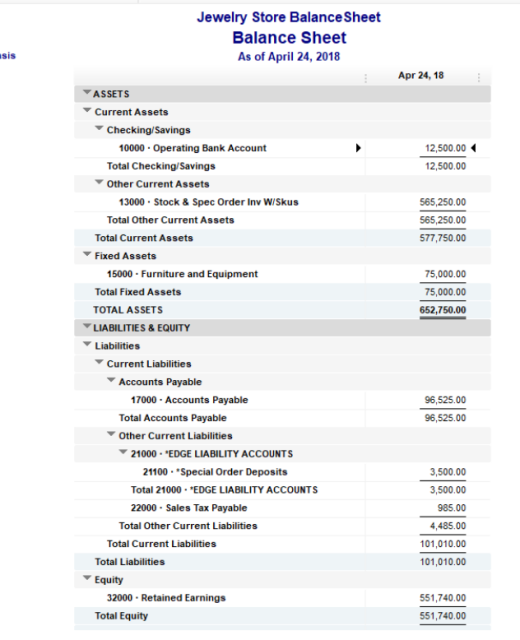

The balance sheet shows us the value of things we own (assets like inventory, shop equipment, showcases) plus how much debt we have (bank loans, accounts payables, credit card debt)

Yours would look like this one

You may been writing your checks by hand and handing the book to your accountant. Some stores print checks in Quickbooks but do not enter deposits and/or sales (what a mess)

What are the advantages of using QuickBooks?

- You're are making a check to pay people and vendors. Wether you're doing it by hand or in your Quickbooks now why do do it correctly?

- If you're writing a check by hand you'll save time writing it in Quickbooks for two reasons.

1. QuickBooks remembers the vendors name & address and the account to use.

2. printing checks via computer is 5 times faster than writing by hand.

- Your books will now be accurate, you're paying your accountant good money because he/she has to figure out what you've done, do it correctly will save you money (remember you're writing the darn check anyway) and you'll be able to see your own P&L monthly.

- QuickBooks can download your charges on your credit card directly from a credit card site right into Quickbooks and after teaching QuickBooks it will have everything in the right expense account. buy something at Office Depot on your Capital One credit card? Download it right into Quickbooks and lickity split will be entered for you into Office expense.

After being setup you can use Quickbooks invoicing system to sell products & services in front fo your customer and print a professional receipt on the spot and your sale with deposit is half way done.

- Or you can continue to hand write receipts and invoices and enter them later in the day in QuickBooks.

- Quickbooks will keep your customer file for contact and mailing list up to date,

- You're doing most of this now by hand, why not automate it and get a great profit and loss statement and save yourself time?

You buy and install QuickBooks on your computer. Fill in the attached document and send back to me, I'll make your file and make an appointment to get you up and running with excellent training.

- $799.00

- You'll get David Geller teaching/instructions and set up on your computer.

- 35 page Bookkeeper procedure Manual

- Laminated chart of accounts specific for your store with your bank name, credits cards, etc. like the chart of accounts pictured way above.

- Plus 3 additional no cost support hours to help you along.

Call David or email if you have any questions at all.

(404) 255-9565

David@JewelerProfit.com

To get started fill out this form and either email it to me or fax it (404) 462-7963. Questions? I have all of the answers.

David Geller

QuickBooks pro Adviser

Questions to help David setup your Quickbooks program

Click filename below to access file

We are PCI Compliant. We do not accept credit card payments from our webpage nor store them

|